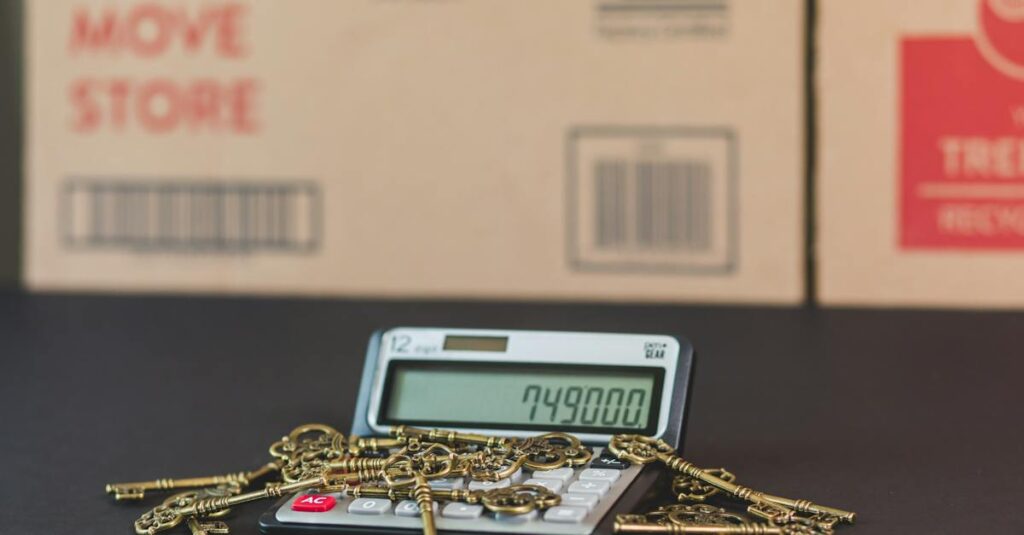

Understanding Stamp Duty on Shares: A Guide to Key Concepts and Tips

Unravel the complexities of stamp duty on shares with our comprehensive guide. Understand its critical role in finalising share purchase costs, promoting fiscal transparency, and curbing fraud. Get handy tips for managing your stamp duty responsibilities, and learn how this crucial levy can impact the share buying/selling process and contribute significantly to government revenue.

Understanding Stamp Duty on Shares: A Guide to Key Concepts and Tips Read More »