The Comprehensive Guide to Buying a Second Home

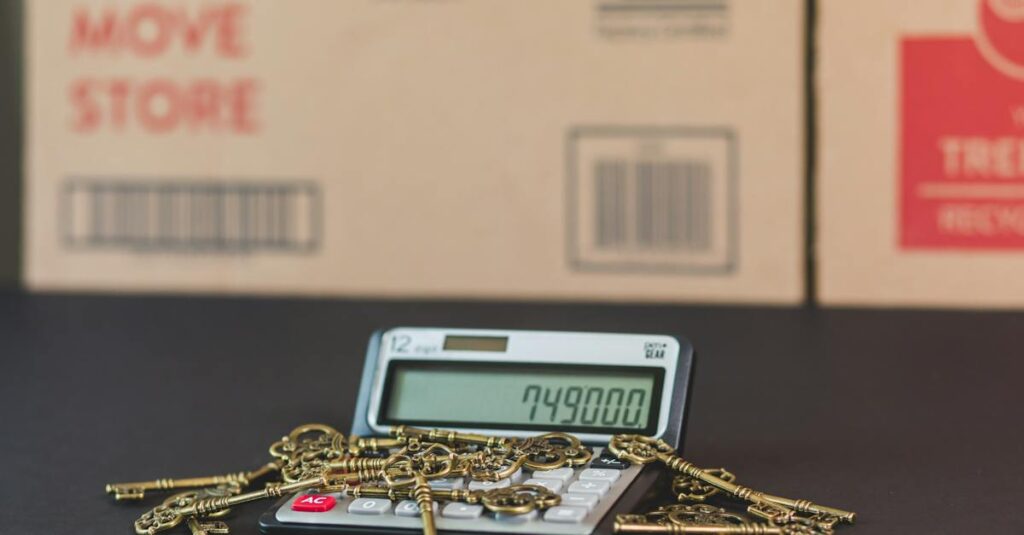

Explore the ultimate guide to buying a second home, highlighting the importance of location and budget planning. Discover diverse financing options, learn how to maximise rental income, and understand the significance of property management. Gain insights from experts to optimise the investment return and manage the purchase process efficiently.

The Comprehensive Guide to Buying a Second Home Read More »